Just as you would want a listing agent to help you maximize the sale of your home, navigating the intricate world of real estate demands the guidance of a buyer’s agent. After all, purchasing a home stands as one of the most significant financial decisions one can make. Amidst the myriad of decisions, paperwork, and negotiations, having trusted and knowledgeable professionals by your side can make all the difference in helping you avoid costly mistakes and missed opportunities. In this blog post, we’ll delve into the crucial role of a buyers agent in the home buying process and explore how their collaboration with mortgage lenders ensures a smooth and informed journey towards homeownership.

Expertise & Knowledge

One of the standout advantages of having a buyer’s agent by your side is their profound understanding of the local real estate market. They know the ins and outs of neighborhoods, property values, and current market trends. Additionally, they offer valuable insights into what it means to be a homeowner and provide education on topics such as insurance and utilities, ensuring you’re well-informed every step of the way.

Guidance & Support

Buyer’s agents are more than just property tour guides. They serve as trusted advisors, listening to your needs and preferences and assisting you in finding the perfect home. From scheduling viewings to gaining access to properties, they handle the logistics, making the process smoother and more efficient.

Negotiation & Advocacy

When it comes to negotiations, buyer’s agents are your advocates. With your best interests in mind, they navigate the intricacies of the negotiation process, ensuring you secure the best possible deal. Their keen eye for detail allows them to evaluate the value of a home relative to the local market, spot potential issues on the property, and advocate for necessary repairs or adjustments.

Example: Jon and Jane finally found a home they loved and were willing to offer $25,000 over the asking price. Their agent, however, suggested they only offer the asking price after performing a comparative market analysis (CMA) that calculates a home’s value based on the recent sales of similar real estate in the area. In the end, the sellers accepted Jon and Jane’s offer at the asking price and saved them the additional amount they were willing to include.

Orchestrating The Transaction

Buying a home involves a multitude of moving parts, from putting together the offer to coordinating with lenders and sellers. Buyer’s agents serve as conductors, guiding you through each stage of the transaction with clarity and expertise. They demystify the home buying process, ensuring you understand every document and decision along the way.

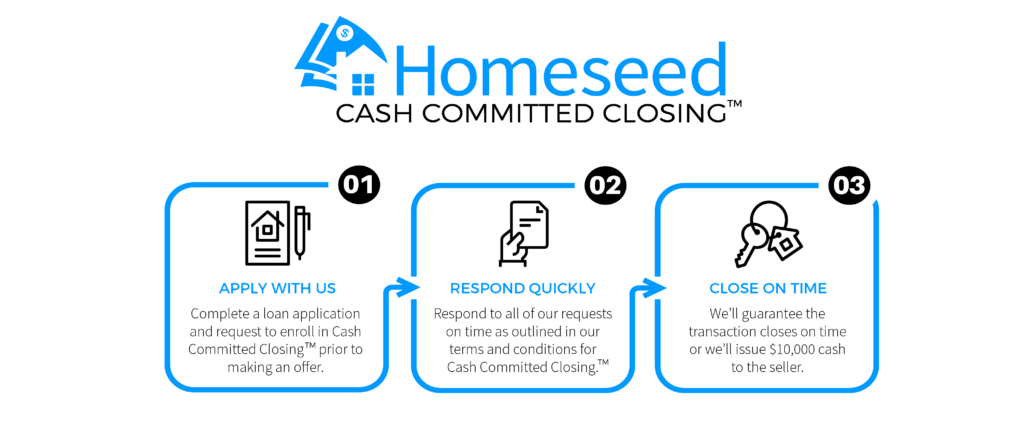

In conclusion, the significance of having a buyer’s agent in the home buying process cannot be overstated. Their expertise, guidance, and advocacy are invaluable assets, particularly when making such a substantial financial decision. As you embark on your home buying journey, remember the importance of seeking professional assistance. Together with Homeseed as your lender, we will work to ensure your home buying experience is seamless, informed, and ultimately, rewarding.